EU emergency measures: the impact of capping market revenues on renewables

The European Commission is keeping busy these days – the unprecedented energy crisis already forced many European enterprises to reduce or halt production, and amid fears of energy poverty during the winter heating season and the ensuing social unrest, the European law-makers adopted an emergency measures proposal to tackle the situation. The measures will not spare the renewables – a revenue cap at maximum 180 EUR/MWh is effective from 1 December 2022, to 30 June 2023. Here, we examine the measures concerning inframarginal electricity producers and their potential impact on the GO market.

Summary

- Mixed market signals and confusion: while the EU’s general political leaning favours renewables and encourages their rapid deployment (e.g., EU Green Deal, Fitfor55, RED), the emergency market revenue cap decreases the market incentive for investors to build additional capacities short-term;

- On the supply side, the regulation sends a bearish signal to investors, and as the European electricity market becomes more regulated, investors’ appetite may be suppressed in the short to medium term. The proposal’s legislative unpredictability and deviation in price cap across EU member states further complicate investment decisions – there are too many unknowns, prompting abstention from concluding new PPAs while waiting for clarity on the cap implementation;

- On the demand side, corporate demand for PPAs is strong: the mismatch between supply and demand will highly likely result in upward pressure on GO prices short to medium term as the volume of bundled GOs issued will decelerate short to medium term. The impact will likely be non-uniform across the AIB members.

Legislative process

The emergency measures to tackle the energy crisis necessitated rapid legislative response; the legislative timeframe fit in less than a month. The proposal was tabled by the Czech Presidency of the EU Council in early September, followed by several meetings of the EU energy ministers at the Extraordinary Energy Council throughout the month, where the details of revenue cap itself were agreed on, inter alia. On 30 September, EU energy ministers agreed on and adopted the regulation.

The European Commission’s emergency measures proposal is in the form of a Council regulation, that used Article 122 TFEU as the legal basis, meaning the regular co-decision legislative procedure (whereby both the European Council and the European Parliament adopt the legislative proposal), did not take place. The European Parliament expressed regret over this in its resolution from 5 October, however agreed in principle that the windfall profit tax is an appropriate measure to tackle the energy crisis.

Next, the Commission will carry out a review of Chapter II (application of the market revenue cap and distribution of surplus revenues to consumers) in spring 2023, inter alia, considering the general situation of electricity supply and prices in the EU, submitting its findings to the Council. Based on that report, the Commission may propose to prolong the regulations’ period of application if the economic circumstances justify doing so, or to amend the market revenue cap, increasing regulatory risk.

In detail: market revenue cap

The measures concerning inframarginal electricity producers are outlined in Chapter II, Section 2 of the proposal. The revenue cap at of a maximum of 180 EUR/MWh will apply to electricity producers using the following sources: wind, solar (thermal and photovoltaic), geothermal, hydropower without reservoir, biomass fuel (solid or gaseous), and waste. While reducing the producers’ profits, the cap will not affect electricity prices: collected revenue will be passed on from producers to struggling businesses and households to help cover electricity bills. The regulation applies to EU member states only. Crucially, they are free to set different price caps at national level, meaning that they are free to deviate and introduce weaker revenue caps.

Technologies using biomethane as input fuel rather than natural gas, were excluded from the list as to not hinder the conversion of existing gas-fired power plants in line with the REPowerEU objectives.

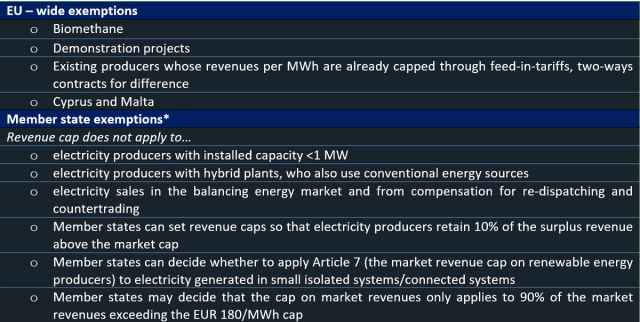

An overview of the various exemptions is provided below.

*MS Exemptions as in member states can decide themselves

Note, the revenue cap is set on market revenues rather than on total generation revenues (including feed-in premiums) and will apply to revenues both under long-term contracts and from participation on wholesale markets. The proposal also mandates member states with net imports of electricity equal or higher than 100% of its own electricity generation in comparison with its main exporting country to have access to agreements to share the surplus revenues with the latter in the spirit of solidarity.

Market assessment

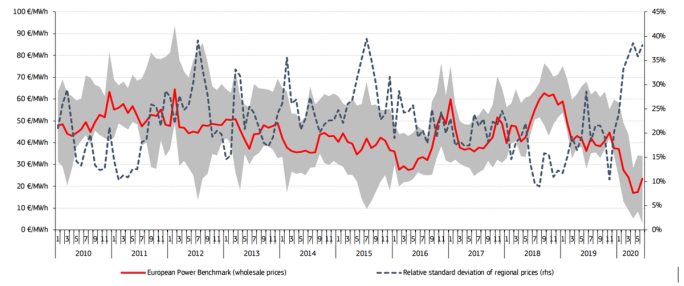

The Commission argues that the revenue cap is designed to preserve the operators’ profitability and avoid hindering investments in renewables; prior to the pandemic and Ukraine war - related electricity price increases, the average peak prices in the electricity wholesale market were below 180 EUR per MWh across the EU (see below). The lawmakers reasoned that the revenue cap leaves a margin on the price that investors could have expected and exceeds the current levelised cost of energy for the generation technologies concerned, thereby allowing producers to cover their investments and operating costs. Analysts at Morgan Stanley were unanimous: the market revenue cap is at a level that will still drive renewables investments.

Despite the generous tariff level for renewables, operators still feel the ripple effects on supply chains and subsequent material costs rises from Covid, as well as inflationary pressure and rising costs of borrowing, rendering the market revenue cap even less palatable.

Nevertheless, it should be emphasised that in September 2022, corporates already surpassed the 2021 PPA deal count level (see graph below), the disparity between deal count and capacity being possibly due to the fact that more PPAs were linked to existing capacity.

In addition, corporates, and members of the RE100 initiative display continued interest in the market; due to their climate commitments, their appetite should not wane in the long run.

A recent consultant study points that the measure will only affect 40% of the total installed renewable capacity in the EU (113 GW), as the majority of renewable installations (170 GW) have fixed revenues from fixed tariff contracts such as Feed in Tariffs, Contracts for Difference, or PPA contracts, mainly located in Germany, France and Spain. These contracts are usually long-term (10 – 15 years) and have a pre-agreed price. This means that majority of renewable installations do not make windfall profits on extreme electricity prices, as they have an obligation to channel surplus revenues to the counterparty in the agreement. In turn, we believe that this could possibly signal that the EU is trying to steer the remaining wholesale market players into concluding short-term (up to 5 years) PPAs to reduce price volatility.

Short-term to medium-term, however, this could translate into investment uncertainty, slowing the PPA market down. Optimistically, the most severe outcome is likely to be project delays and renegotiations of long-term projects still under development, and at worst it might prevent the signing of future PPAs, potentially reducing volumes.

We believe that the biggest concern for renewables is the potential prolonging of the market revenue cap beyond the stated six months: gas prices are likely to remain high in the next couple of years due to tight gas market, making it more difficult for EU member states to fill up their storages, therefore driving gas and electricity prices up. If the measure is to stay for more than originally intended, renewable investors’ confidence could sink even lower. Indeed, the European Parliament called on member states to temporarily limit the emergency measures in order to maintain investors’ confidence in its resolution: “…interventions in the energy market should be of a temporary and targeted nature and… fundamental market principles and the integrity of the single market must not be endangered”. Notwithstanding, if the market is expected to be volatile, PPAs could become a secure and attractive tool for buyers by offering predictable, fixed prices from the outset, thereby helping them to hedge electricity costs.

Impact on the GOs

Since PPAs are usually bundled with GOs, the latter will also be affected. As a preliminary assessment there are two possibilities: GO supply on the market could increase if more short-term PPAs (<5 years) will be concluded as investors seek price stability, or PPA – bundled GO supply could decrease short to medium term, as market participants wait out for calmer regulatory and market waters.

We expect that out of the two scenarios, the more pessimistic outlook is more likely short to medium term: on the supply side, the regulation sends a bearish signal to investors, as with more market interventions, there are too many unknows in the equation, prompting abstention from concluding new PPAs while waiting for clarity on the cap implementation. Although the third emergency measures package aims to accelerate renewables deployment by speeding up permitting times for one year and may somewhat whet the investors’ appetite, it alone may not be enough to turn the situation around. On the demand side, corporate demand for PPAs and GOs will remain strong (e.g. RE100 members recently updated its technical criteria to purchase EACs from new renewable electricity installations). This could lead to a mismatch between supply and demand, short to medium term resulting in an upward pressure on power GOs prices as the volume of new bundled GOs issued will decelerate. GOs prices have been on a rising trajectory since 2021, and we expect this trend to continue, compounded by regulatory signal that in turns chills the PPA market, thus lowering PPA-bundled GO supply.

The EU is not done with market interventions: short-term measures such as the market revenue cap are rolling out faster than others, while others such as developing a TTF benchmark substitute and reforming the EU’s electricity market, will take longer to finalise. We will keep you updated on these developments. Should you have any questions, please contact our Renewable Policy Analyst mary@greenfact.com.