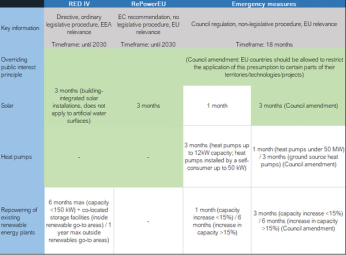

Permitting times under RED IV, RePowerEU, and emergency measures

Currently, the European decision-makers are working on several files to accelerate permitting times for renewable energy projects: faster procedures are foreseen under the revised Renewable Energy Directive (RED IV) coming out of the RePowerEU plan to speed up the green energy transition and phase out dependence from Russian gas, and the latest emergency measures package. Here we provide an overview of the state of play, highlighting key differences and similarities.

REPowerEU

The REPowerEU plan was presented on 18 May 2022 and encompassed multiple files to tackle the energy crisis and lessen dependence on Russian fossil fuels. It emphasised faster permitting times for accelerated renewables deployment and included the European Commission’s recommendation on speeding up permit-granting procedures for renewable energy projects. The file introduced the overriding public interest principle, thus limiting the grounds of legal objection to new renewable installations.

At the same time, the plan outlined the contours of the future European energy landscape by suggesting frontloading solar and wind energy, in line with the European Green Deal and the EU Solar Strategy. The Commission’s recommendation also proposes a three-month permit-granting period for solar installations and does not cover repowering of existing installations and heat pumps.

Alongside the REPowerEU plan, a proposal for a revised Renewable Energy Directive (RED IV) was presented.

RED IV

In RED IV the Commission proposed to increase renewable share in the EU final energy consumption to 45% by 2030 and included enhanced measures to accelerate permitting procedures for new renewable power plants or adaptation of existing installations. Under the proposal, Member States would designate “go-to areas” suitable for renewable installations and that would benefit from accelerated permitting procedures. The proposal upholds the overriding public interest principle, maintains the Commission’s recommendation for solar permitting times and suggests permitting times for the repowering of existing renewable energy plants (see table).

On 14 November, MEPs backed speeding up permitting for renewables and introduced amendments to the Commission’s RED IV proposal. Specifically, they suggested that EU countries ensure that the permitting process for new installations does not exceed 18 months (as opposed to two years proposed by the Commission) and set up the “renewables acceleration areas” (renamed from “go-to areas”) within two years. In turn, permitting in these areas would be limited to nine months, compared to the one year in the proposal. Permitting for projects outside the “acceleration areas” would be limited to 18 months as opposed to two years in the original text. Note, that there is currently no consensus for the overriding public interest in the European Parliament, therefore this will be voted as a separate amendment.

The European Council has yet to deliver its general approach. Once done, if the proposed amendments between the European Parliament and the Council differ, interinstitutional negotiations (trilogues) will follow.

Third package of emergency measures

The European Commission introduced a third emergency measures package on 9 November this time targeting renewables. Note, the emergency measures act as an in-between step, building on REPowerEU and have strong links with RED IV currently under negotiation. It aims to accelerate permitting for renewables in the short run and in a temporary manner until the provisions of RED IV come into force. The regulation retains the overriding public interest principle, has same permitting time for solar installations as Commission’s recommendation and RED IV, however adds heat pumps deadlines and repowering of existing renewable power plants to the list (see table below).

On 24 November, the European Council reached agreement on the Commission’s proposal with some changes. Among them: the possibility for Member States to further shorten the deadlines of permit – granting process, the ability to apply this regulation to the ongoing permit requests; and the extension of application period beyond one year to 18 months with possibility for prolongation (in December 2023). The Council also addressed concerns regarding the overriding public interest, allowing Member States to restrict the application of this presumption to certain parts of their territories, technologies or projects and carry out a simplified environmental assessment, as the original proposal derogated from several environmental obligations included in some EU directives.

* Information in the table according to the European Commission’s proposals, unless stated otherwise (e.g. Council amendments)

While the REPowerEU plan sets the course for European lawmakers, the Commission’s recommendation suggests a line of action without imposing any legal obligation and has no binding force. The revision of RED IV follows an ordinary legislative procedure, whereby both the Council and the European Parliament co-decide. The MEPs already presented their amendments (see timeline) with the Council due to submit theirs. The Directive has EEA relevance, meaning both EU Member States and Iceland, Liechtenstein and Norway will need to implement faster permitting times, while leaving them free to choose how to do so. The transposition into national law can take up to two years, therefore the Directive will not be immediately implemented in the EU Member States.

The emergency measures proposal was tabled by the Commission in the form of a Council regulation. This means that the European Parliament is bypassed and there is no co-decision process as under the ordinary legislative procedure, consequently the adoption will be done via a non-legislative procedure. The European Council was due to reach political agreement on 24 November but instead, the ministers want a package deal both on permitting and gas purchases, therefore adoption will have to wait until the new Energy Council Meeting in December. Once adopted, the emergency measures will apply to all EU countries and are binding in nature.

Impact on the GO market

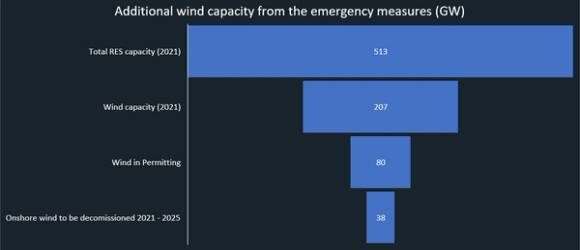

RED IV amendments should help increase the supply of renewable capacity long term, helping to accelerate renewable energy deployment, thereby matching strong corporate demand from RE100 members (e.g., RE100 recently updated its technical criteria to purchase EACs from new renewable electricity installations). As concerns the emergency measures, the effect on the market will be more immediate: since faster permitting rules and the overriding public interest will apply to new and ongoing projects, they would effectively unlock around 100 GW of wind and solar projects currently stuck in permitting procedures.

This is a considerable amount: taking wind as an example, bringing online capacity comparable to 40% of existing onshore wind installations (207 GW) (see graph below), will relieve the anticipated supply crunch stemming from the market revenue cap on inframarginal producers, which already sends a bearish signal to investors. Furthermore, repowering an additional 38 GW of onshore wind capacity that is reaching the end of its operational life between 2021 and 2025, should ensure continuity of renewable energy supply both medium and long term, limiting the effects of supply disruption.

Since the emergency measures will only be adopted at the end of 2022, supply growth will be somewhat delayed. Nevertheless, these measures should balance out the negative effects of the market revenue cap, likely easing the upward pressure on GO prices medium term. Thus, we can in all probability expect renewable supply to match growing demand in the medium and long run.